Bitcoin Returns to All-Time Highs

ETF inflows remain strong but now we're at resistance. Here's my game plan.

Report Summary

Fundamentals: Bullish

Net ETF inflows remain positive

Sentiment: Neutral

Crypto natives are getting euphoric, and normies are starting to get back into the market, but I don’t think either group is in full on FOMO mode or over-allocated yet

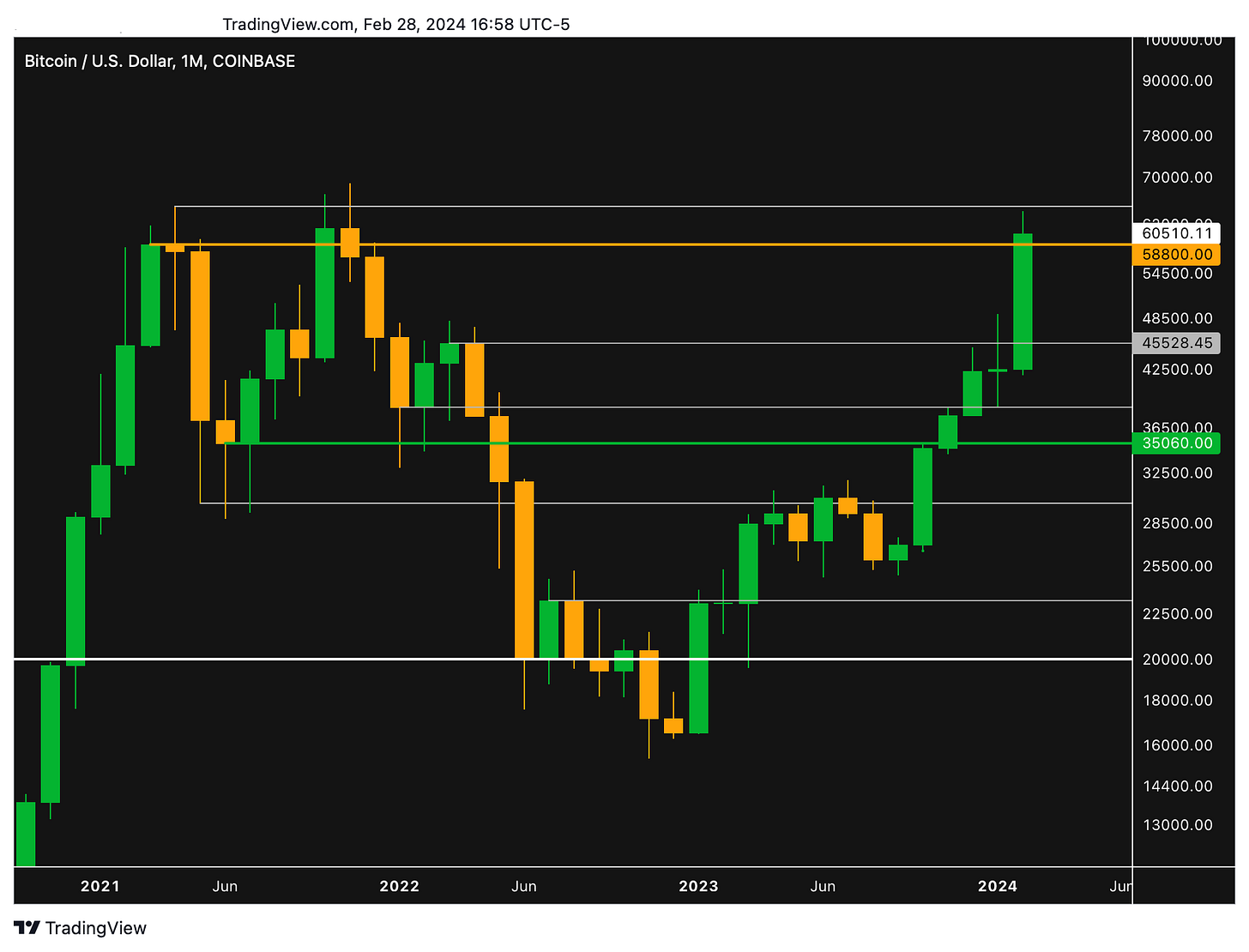

Technicals: Neutral

Medium-term: Bearish—Bitcoin is at a key resistance level on the monthly and weekly charts, prior all-time highs at around $60K.

Long-term: Bullish—The quarterly chart is still in an uptrend, within a massive rising channel.

My Long-Term Outlook and Game Plan for Bitcoin

Bitcoin is at a key resistance zone (orange line) on the monthly chart. This is technically bearish.

However, I’m not expecting a major pullback because we’re now in the Wall Street Era of Bitcoin. I expect less volatility, and more consistent positive returns over the long-term. Like the stock market.

I don’t think it’s worth trying to time tops and dip targets. There’s less to be gained from doing so. There are also more professional traders in the market now, so it will be harder to do.

Dollar cost averaging is a better strategy in this new environment, in my opinion.

Zooming out on the quarterly chart, you can see that Bitcoin is in a massive uptrend. I don’t see any reason to fade a chart that looks this good.

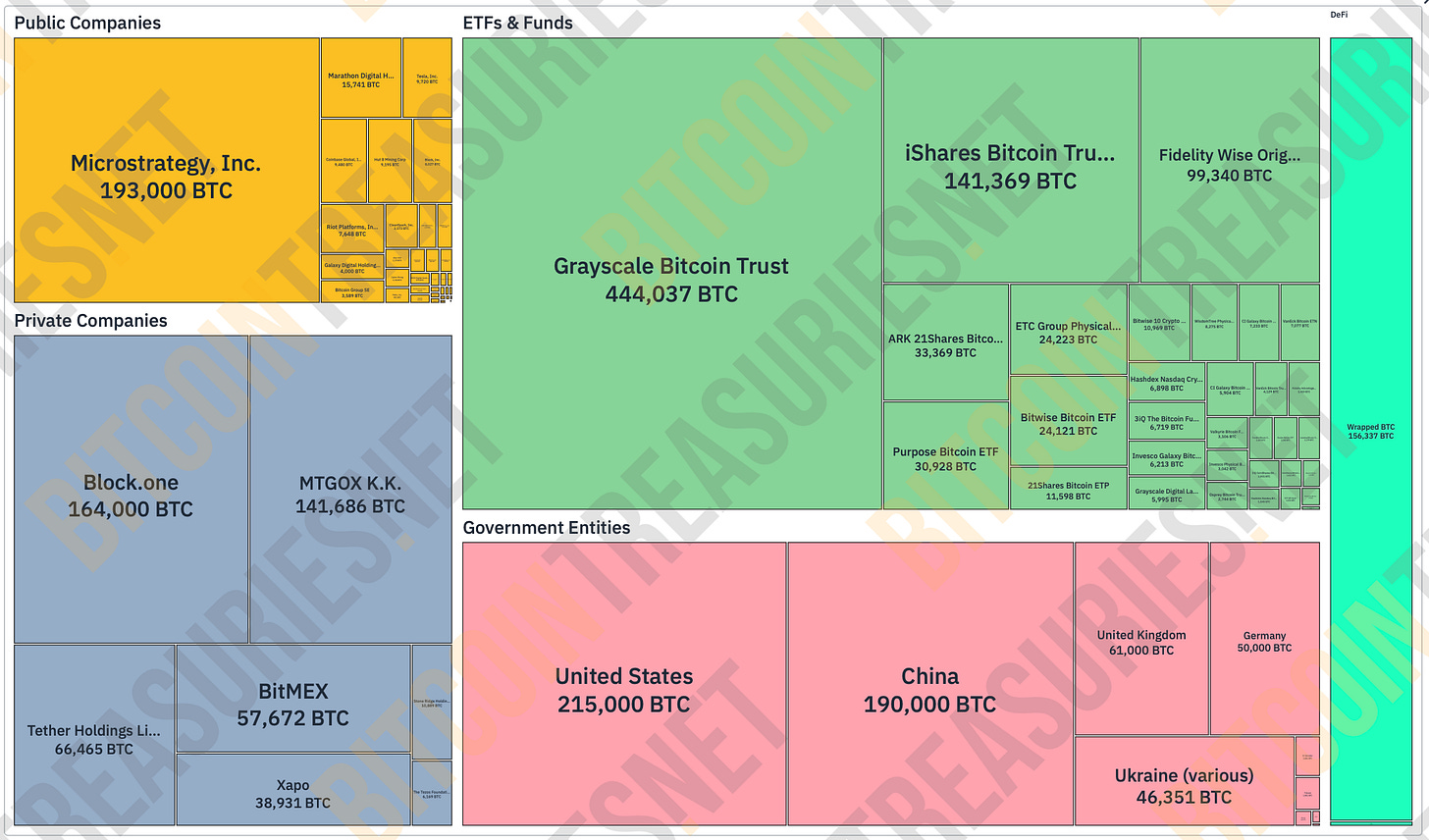

We should have plenty of more room to the upside in the coming years and decades because people will be dollar cost averaging into the Bitcoin ETFs in their retirement accounts, and more institutional investors will allocate a portion of their portfolios.

My game plan

I don’t see any obvious medium-term swing trades.

When Bitcoin crashed to $16K after FTX collapsed, that was an obvious buy to me (not in terms of the probability of it being a successful trade, but in terms of the risk versus reward).

When Bitcoin crashed back down to $20K in March 2023 after Silicon Valley Bank collapsed and USDC de-pegged, that was an obvious buy to me.

When Bitcoin broke out above $35K because of the ETF narrative, that was an obvious buy to me. I talked about this trade months before it was signaled.

When Bitcoin rallied leading up to the ETF approval date at the beginning of this year, shorting MicroStrategy was an obvious trade to me.

I don’t see an obvious long or short trade right now. We’re technically at resistance, but I’m not going to fight against this insanely strong bullish market.

Dollar cost averaging and holding for the long-term seems obvious to me now.

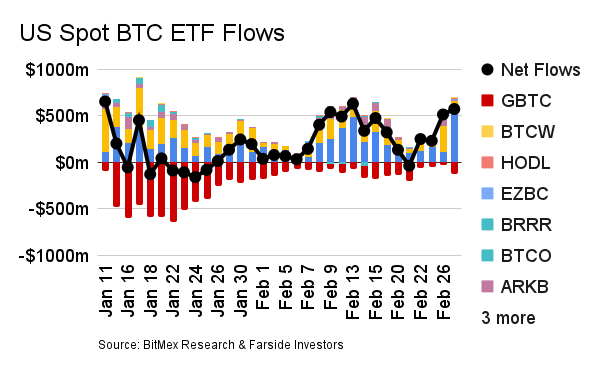

ETF Inflows Remain Strong

Net ETF inflows are the key fundamental indicator to watch right now, in my opinion.

Right now, this indicator is bullish.

There’s more money buying the new nine ETFs than there is selling GBTC.

I don’t see any reason to be bearish on any time frame unless that changes.

I also think this indicator is more important to watch than the technicals for now because the ETFs already own so much of the total supply of Bitcoin.