This report covers:

Why Bitcoin sold off after the ETF was approved

Rotation trade opportunities

My game plan for buying Bitcoin

The Beginning of a New Era

On Wednesday, the SEC approved listing of Bitcoin spot ETFs! This is a momentous event in Bitcoin’s history. Bitcoin is now mainstream.

But it wasn’t without a fight from Elizabeth Warren and her “anti-crypto army”. Warren took to X to accuse the SEC of being “wrong on the law”, and spread misinformation. She was fact-checked by X’s Community Notes:

Holding Bitcoin through a third party is somehow antithetical to the fundamental value of crypto, but the news (and narrative about the news) will most likely bring in the next generation of investors who didn’t feel comfortable with self-custody or buying through Coinbase.

BlackRock CEO Larry Fink went on Fox Business and said that if you’re fearful of government, or worrying your government is devaluing the currency, then you could see Bitcoin as a great potential long-term store of value, like digital gold.

Fink’s continued PR campaign for Bitcoin is persuasive because many investors view him as highly credible and trustworthy. It’s not just a bunch of Libertarian-esque weirdos with laser eye profile pictures shilling crypto anymore. I believe more people will be persuaded to buy Bitcoin because of this.

Why Bitcoin Dumped After The Approval

After the ETF was approved, Bitcoin dipped about 15%, with most of the down move happening yesterday.

Why did the market sell off after such positive news? Was this a “buy the rumor, sell the news event” that was already priced in?

The short answer is GBTC redemptions and outflows. Let’s dive into some charts to see how it’s playing out and where the trade opportunities are.

GBTC Continues to Wreak Havok on Crypto

Investors who bought into the GBTC Widowmaker Trade when the trust was trading at a premium have been trapped since it started trading at a discount. In addition, some people bought GBTC more recently to arbitrage the discount, in anticipation of it being converted to an ETF.

Now that GBTC has converted from a trust to an ETF, the discount has largely been eliminated (it’s trading at parity to its underlying Bitcoin).

However, GBTC’s management fees are far higher than the other spot ETFs. So now that the discount arb trade is over, and those who had been stuck in the Widowmaker premium trade have been made whole, many people are selling their shares or redeeming the underlying Bitcoin.

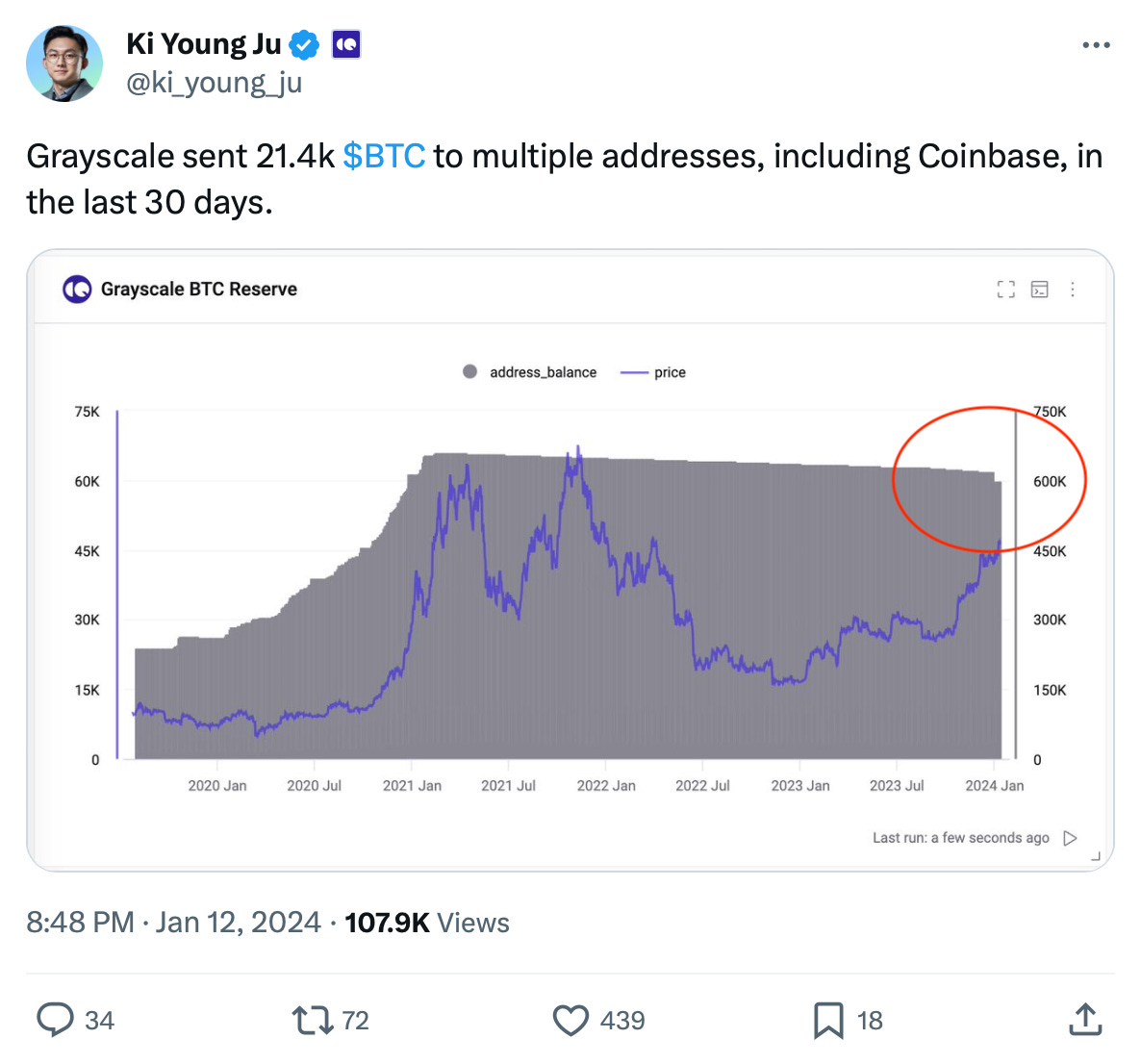

On-chain data from Cryptoquant shows Grayscale’s (the manager of GBTC) massive Bitcoin reserve is beginning to decline because of redemptions and share sales:

According to Bloomberg ETF Analyst, Eric Balchunas, GBTC has had $579m of outflows (people selling shares) since the trust converted to an ETF.

GBTC shares have been underperforming the other spot ETFs because of these dynamics.

So what’s the play here now? I took a hedge trade: short MicroStrategy, long Ethereum. Here’s why and the next opportunities I see.

Why Buy MicroStrategy Instead of the BlackRock ETF?

MicroStrategy is a publicly traded holding company run by Michael Saylor that holds 189,000 bitcoin (worth about $8 billion). They buy Bitcoin through issuing debt and selling equity shares.

MicroStrategy stock (MSTR) was a way for investors who didn’t feel comfortable with self-custody or using Coinbase, and didn’t have access to a Bitcoin spot ETF managed by BlackRock, to get exposure to Bitcoin.

Now that BlackRock’s spot ETF is publicly trading, I think some people will rotate out of MSTR.

Depending on which analyst you listen to, MSTR might be trading at as much as a 70% premium to its underlying Bitcoin holdings.

In addition, as I said in my previous report, I suspected the ETF approval would be a “sell the news event”. Those were my fundamental reasons for taking this trade:

I got in a little bit early, but it was a good enough trade that it’s well into profit now. I plan to cover this trade soon though, and I think it’s too late to enter it now.

I also don’t want to have much short exposure to Bitcoin or crypto given the tailwinds that I believe the spot ETF will provide in the years to come, so I wanted to hedge with long exposure. I chose to long Ethereum (instead of Bitcoin). Here’s why and where I think Ethereum will go next.

Ethereum Outperforms Bitcoin After ETF Approval

As I said in my previous report, the first sign of rotation into ETH from BTC would be if the trading pair reclaimed 0.055 (the horizontal green line). So when it reclaimed that level, shortly after the Bitcoin spot ETF was approved, I bought Ethereum.

ETH has been outperforming BTC since then, however it has not been performing as well in terms of dollars because of the GBTC shenanigans discussed above.

GBTC redemptions and outflows may continue to put downward pressure on crypto for a bit, but ETH (and BTC) charts look solid long-term. The ETH weekly chart above is in an uptrend and all three moving average lines are trending up. My ETH long position also provides a hedge for my MSTR short, which I’m staying in for now.

My Bitcoin Game Plan

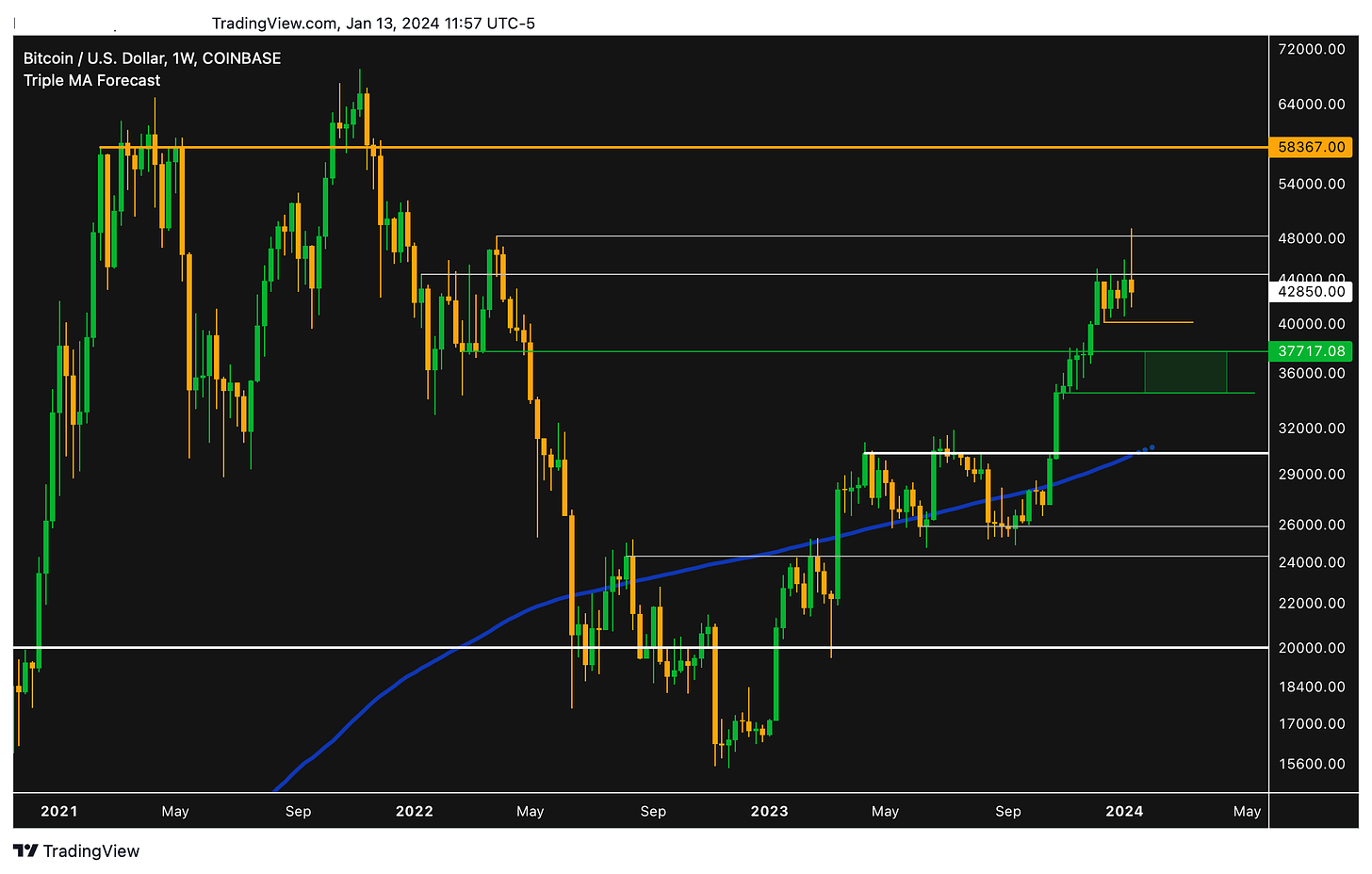

The BTC monthly chart looks great. It’s in an uptrend—making a series of higher-highs and lower-lows, as indicated by the grey arrows. And it reclaimed the prior cycle’s high range at $35K (green horizontal line).

However, it can certainly pullback further. If it does, I’ll be looking to buy within the green box between $38.5K and $35K. This is similar to when I bought Bitcoin back in October when it first traded above $35K.

I would have a pretty tight stop loss. If BTC started trading below $35K, I would be worried that the ETF narrative has lost steam, perhaps because of disappointing inflows.

The BTC weekly chart tells a similar story. I’m looking to buy in the green box between $37.7K and $34.5K with a tight stop loss.

These entry targets on the monthly and weekly charts align with this daily chart that I shared at the beginning of this report. On the daily chart, $38K was the break out point from the ascending trial back at the beginning of December.

What to watch for

I’ll be watching the net of spot ETF inflows and outflows. The ETFs need to meet expectations now. As long as the don’t totally bomb, I think it will be safe for me to shift my strategy from swing trading and timing market cycles to dollar cost averaging and long-term investing.